Whether you’re planning to sell, updating your insurance, or are simply curious, knowing the value of your land — separate from any buildings — is crucial. This guide will show you several ways to determine your land’s value, from quick estimates to the formal calculations required by the IRS for investment properties.

Quick Methods for General Estimates

If you’re just looking for a general idea of your land’s value for personal reasons - not for formal tax or legal purposes - these methods are a great starting point.

The County Tax Assessor Method

A quick and easy way to get a rough estimate is to look at your property tax bill. Your county’s tax assessor has already separated the value of your land from the value of any buildings on it. While these values might not perfectly reflect the current market, they provide a simple ratio you can use.

The Sales Comparison Approach (for Vacant Land)

Another way to get a general idea is to look at the prices of recently sold, similar, vacant lots in your area. By comparing your property to these sales, you can get a good sense of its approximate market value. This is a common method used by appraisers to determine land value.

Looking to value vacant land on its own? Check out How Much Is My Land Worth?

How to Formally Calculate Land Value for Depreciation & Tax Basis

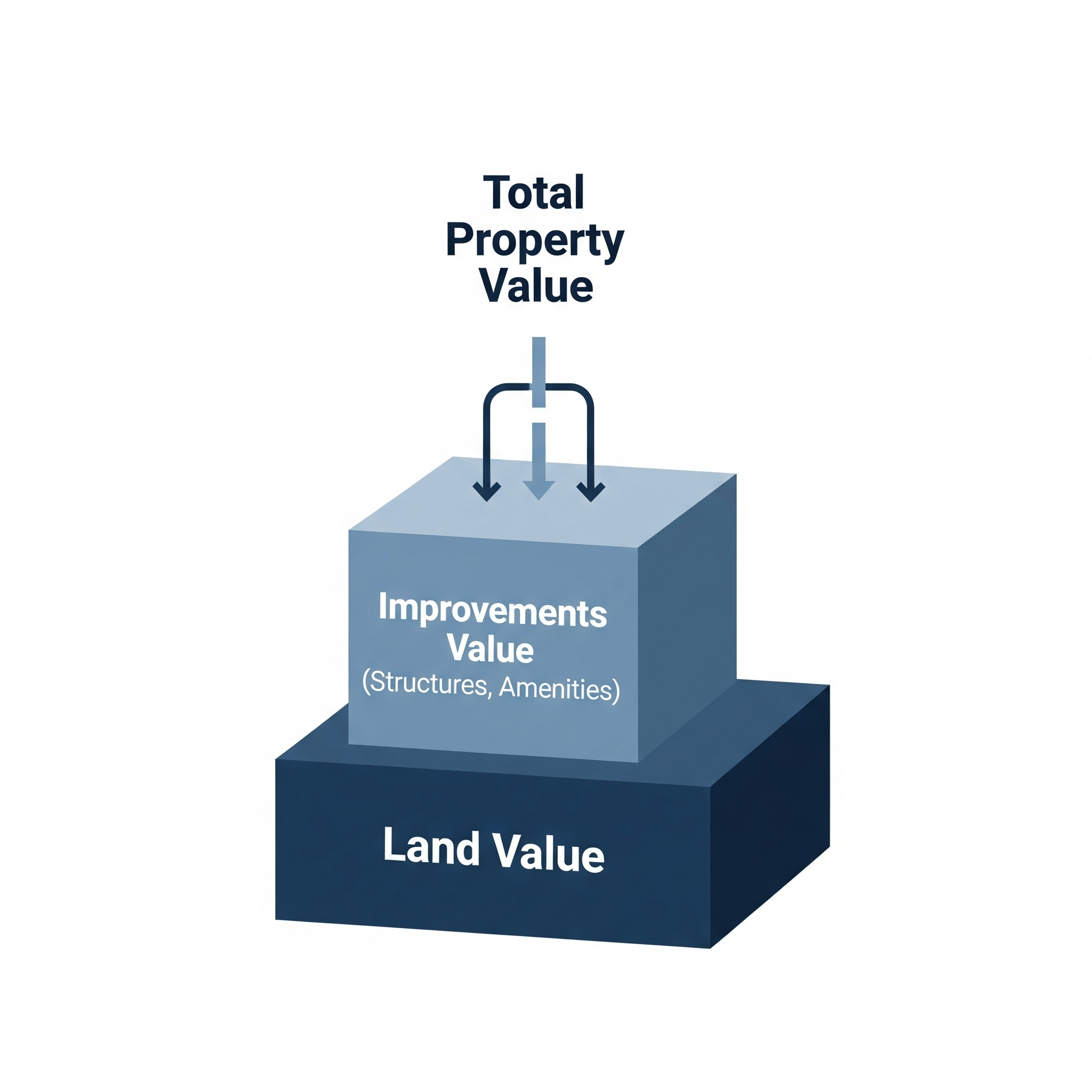

For real estate depreciation and other tax purposes, you must separate the land value from the value of any buildings and improvements. This is because land cannot be depreciated, but buildings can. Accurately calculating land value ensures you stay compliant with IRS rules and maximize your allowable deductions.

Why You Need to Calculate Land Value for Tax Purposes

If you own an investment or rental property, you’ll need to figure out your land’s value for tax purposes. This establishes your cost basis for depreciation. The IRS requires a “reasonable method” to allocate your property’s original purchase price between the land and building. This applies strictly to investment properties; you can’t depreciate your primary residence.

Accurately calculating land value helps you:

- Stay compliant with IRS rules and avoid audit risk.

- Maximize allowable deductions by depreciating the correct building value.

- Plan smarter for property sales, since depreciation impacts capital gains calculations.

If you skip this step or estimate incorrectly, you could either lose out on valuable deductions or face costly penalties down the road.

Planning a property sale? Check what taxes you’ll owe with our capital gains calculator.

According to IRS Publication 551, there are two ways to calculate the land and the building: by using their fair market values at the time of purchase or by using the assessed values from your property tax bill.

Method 1: Using an Appraisal Report (Most Defensible)

An appraisal report is the gold standard for separating land and building values. If you got one when you bought the property, check the “Cost Approach” section in your Uniform Residential Appraisal Report (URAR); it usually breaks down “site” (land) and “improvements” (building).

If you didn’t get an appraisal at purchase, you can commission a retrospective appraisal. This means an appraiser estimates the value from a past date. It costs money, but provides strong documentation if you face an IRS audit and is highly accurate for setting your cost basis.

Method 2: The County Tax Assessor’s Allocation (Very Common)

This is often the easiest, most common way to split your property’s value. Your county tax assessor already separates land and building values on your property tax bill.

Here’s how to use it:

- Get your property tax bill from the year you placed the property in service, or visit your county assessor’s website.

- Find the “Land” and “Improvements” (building) assessed values.

- Calculate the land’s percentage of the total assessed value: (Assessed Land Value / Total Assessed Value).

- Apply that percentage to your actual purchase price to find your land’s cost basis.

This method is free, straightforward, and uses official figures. However, assessed values might not perfectly reflect market value ratios.

Advanced Method for Commercial Properties: Cost Segregation Study

For larger commercial properties, a cost segregation study is a sophisticated option. It’s not just about splitting land from building. Instead, it’s a detailed, engineering-based analysis that breaks down property components into various asset classes.

This strategy offers more than a simple land/building split and can significantly boost your tax benefits through accelerated depreciation.

What if you don’t separate land and building values for depreciation?

If a land/building split isn’t properly substantiated, the IRS may reallocate, reduce depreciation deductions, and may assess penalties or require paying back-tax with interest.

There are real, documented cases where the IRS has audited taxpayers over the land/building value split used for depreciation on their taxes.

In a 2017 case (Nielsen v. Commissioner), a Los Angeles property owner claimed depreciation on the entire purchase price of their property—land and buildings together. The IRS audited the property and said that was wrong, since land can’t be depreciated. The dispute went to court because they couldn’t agree on how much of the price was for the land versus the buildings. The IRS used values from the Los Angeles County Assessor, and the court ultimately decided those assessor values were more reliable than anything the taxpayer provided.

Conclusion

The main point is that the land and building values need to be separated. The values also cannot be a simple ratio or percentage. The methods outlined above should hold up in the event of an IRS audit.

Frequently Asked Questions

What is the formula to calculate land value?

If you buy land and buildings together, you can calculate the land’s value using this formula:

Land Value = Total Purchase Price × (FMV of Land ÷ (FMV of Land + FMV of Building))

Where:

- Total Purchase Price = the lump-sum amount you paid for the property

- FMV of Land = fair market value of just the land at purchase

- FMV of Building = fair market value of the building at purchase

What does it cost to get land appraised?

A professional land appraisal by a certified appraiser isn’t cheap, but it’s a valuable investment. Costs typically range from $300 to $1,000, sometimes more for complex or large commercial properties. Your location and the land’s unique features determine the final price.

How to calculate land value for tax purposes?

- Appraisal Report: Check your original appraisal report for the “Cost Approach” section that breaks down “site” (land) vs “improvements” (building), or get a retrospective appraisal if you don’t have one.

- County Assessed Value: Use your property tax bill to find the “Land” and “Improvements” assessed values, then calculate: (Assessed Land Value ÷ Total Assessed Value) × Your Purchase Price = Land Cost Basis.

What about demolished buildings?

When you demolish a building on your land, you can’t write off the demolition costs as a current tax deduction. Instead, you need to add these costs to your land’s cost basis. This includes:

- Demolition costs

- Any other losses from the demolition

- Costs to clear the site

These costs must be added to the basis of the land and are only recovered later when you sell the property.

Please consult your financial advisor, accountant, real estate attorney, or tax professional. This article is for informational purposes and is not tax or legal advice.